Finding the Balance of Conflict & Control in Pursuit of Financial Strategy & Impact

Family businesses are some of the most influential organizations. They can be impactful as employers, and they can drive communities. They have opportunities for a financial strategy that other entities don’t.

Family businesses can hold a special spot of celebrity and respect.

For our Alberta community, one of those entities is Shaw.

In Canada, it’s Rogers.

The announcement of their merger is a hot topic for the family business.

We wanted to stay on trend and touch on the family business as it applies to many growing SMEs & clients of ours.

Family Businesses of all Sizes are Unique.

Financial Strategy & Community

There are financial opportunities that are unique to family business & owner-managed business. They can set a financial strategy that is long-term and nimble.

The ability to impact the community is also unique.

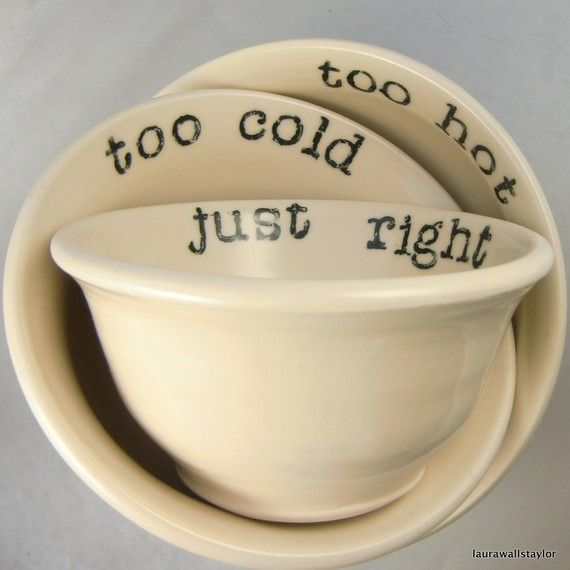

We think it all comes down to a classic story. When Goldilocks has to find “just right,” she’s faced with choices that are too much, just right, and not enough.

We see similar dilemmas in family-owned entities and owner-managed businesses too. But the family dynamic seems to amplify these challenges.

Finding opportunities, including financial strategy in a family business, is a challenge that leads to tremendous results.

Let’s address the challenge of getting it “just right” in the areas of conflict and control.

CONFLICT

You’ll find cases of conflict in a family business. Passion and emotion can be a regular thing.

One business coach told us, “I wouldn’t have a business if it weren’t for the family business.” She said this about helping family partners navigate working together.

It can go beyond that, though. In a family business, employees are like family. Culture always matters. But when you consider your team’s family, culture has even more importance. The loyalty that comes with this perspective can add value to the business.

It’s essential to see the opportunity in this unique structure and to see how you can meet market demands by leveraging the culture.

- Where does the team shine and understand their customer and client in a way others don’t?

- How can you find relevance and build a new product or service, or experience?

- Or are there core competencies that you can grind and make more of if you go deeper?

Significant decisions that have a long-term financial impact can be possible in family businesses because of the willingness to have healthy conflict conversations.

And the desire for legacy and the greater good can make the players genuinely challenge each other and make each other’s ideas better.

As a CFO, you can forecast and explore scenarios that are exciting and visionary. You can rely on funding and support from owners that give you confidence that you can afford to play the long game or take the risk.

It’s a fun place to lead & work!

The opportunity to find financial success in running a family business is not insignificant.

CONTROL

When family business gets control just right, it can win. It can set a financial strategy that is a competitive advantage.

Governance, management, ownership, and organizational structure always matter in business.

It can be more complimentary with a family business.

An inspiring family-managed company tends to bring out the best in a team. The culture, loyalty, and alignment with values and purpose often beat out the competition, resulting in profit and impact (financial strategy!).

However, the family’s influence means that absenteeism or entitlement is noticed and can drag down possibilities. A family member who exerts power and decision-making can be toxic if they aren’t supportive and involved. Conversely, if someone in the family isn’t engaged or involved, that stalls progress and possibilities.

TOO MUCH: showing up on occasion like a seagull to sh** on things isn’t all that helpful.NOT ENOUGH: family leaders who don’t delegate or empower can crush the spirit that is needed to get the work done.Too often, family businesses have both characters, and it’s crucial to “get it JUST RIGHT.”

A COO of a significant Canadian family business once told us, “I realized I’d better start getting an invite to dinner because all the decisions I was expected to execute seemed to happen there.”

When you do get it just right, the ability to earn money and use it to grow and make a difference is instrumental. Why? Because just like a family business can think long-term, they can also execute much quicker decisions and move way faster than a company loaded down with bureaucracy and “too many cooks in the kitchen.” The dynamic opens the door to a financial strategy that most companies can’t consider.

As CFO, you can support by clearly defining how you are going to win.

You can set the key performance indicators and report on them to the family, board, and executives at the overall level. The metrics help support those with control as they operate with aligned goals and share data. When there’s a clear set of one truth, you can amplify decision-making. Similarly, each executive and leader can get support from you.

It’s a powerful opportunity and, again, a fun place to lead and work!

Generations

One common situation we’ve seen as a family moves from the founder generation to the second or third generation relates to control and conflict.

The visionary founder often has the luxury of organic growth and making many decisions from the gut. Often, the sole founder (or the siblings) is driven by the big picture and the goals they set out to achieve.

When their children take over, they aren’t founders. They may have worked elsewhere, grown up in the business or had the chance to get an education. By the time they take over, the company has outgrown the scrappiness of its early years. Many times the new generation sees a need for scale, including process, policy and automation. In regards to technology, they often have a different view as a result of their generational lens.

This change of control can cause conflict. The change management of the maturity can be very tough on loyal, long-term employees. It can also be challenging for the founders too!

The resistance and conflict can make the company stall or even regress in growth.

This can cause further conflict within the business and family roles and responsibilities.

Family businesses that stay the course and work through the change to invest in scale can find themselves with a foundation that far exceeds the competition.

Working Within A Family Business

It can be a genuine transformational opportunity!

A CFO can help select systems, make practical decisions for processes and focus on growth and strategy. The CFO support sets you up to scale. With the proper focus on culture and change management, real investment is transformative.

Conflict and control are just two areas where a family business can strive to get “just right,” and a CFO can support it. When you face these challenges head-on, the opportunities are exhilarating.

Listen to these podcasts for more on family business:

Social Media